- 24H Open Interest$89,933,186,417.06-2.19%

- 24h Liquidation$280,833,181.130%

- 24h long/short Ratio49.21% / 50.79%

- Fear & Greed Index11

- Bitcoin Price$67,899.9-1.6%

- Ethereum Price$1,974.68-1.56%

- Solana Price$83.92-4.05%

- XRP Price$1.49-2.09%

- 24H Open Interest$89,933,186,417.06-2.19%

- 24h Liquidation$280,833,181.130%

- 24h long/short Ratio49.21% / 50.79%

- Fear & Greed Index11

- Bitcoin Price$67,899.9-1.6%

- Ethereum Price$1,974.68-1.56%

- Solana Price$83.92-4.05%

- XRP Price$1.49-2.09%

Maker vs Taker Fees in Crypto Explained

Read about the difference between maker and taker fees in crypto exchanges, understand their purpose, and how to use both strategically to reduce expenses.

Key Takeaways:

- Maker-taker fees are pricing mechanisms applied to limit and market orders, defining whether traders provide liquidity or execute immediately at market prices.

- Crypto exchanges implement diverse structures, including low-cost platforms like MEXC and KCEX or token and VIP-tier incentives offered by Binance, HTX, and Bybit.

- Traders should remain aware of potential risks such as liquidity fragmentation, rebate-driven trading, and uneven incentives that may distort price discovery or execution fairness.

Crypto traders often wonder why the same trade costs slightly different amounts depending on how they place their orders. You might be comparing exchanges, seeing terms like maker fee and taker fee, and questioning which one actually saves you more money.

Understanding these fees isn’t just about knowing what they mean; it’s about seeing how they directly affect your profitability and trading style. Whether you’re day trading, scalping, or swing trading, grasping the maker-taker model helps you trade smarter and keep more of your gains.

Continue reading for a full breakdown of maker-taker fees in crypto. ⬇️

Maker vs Taker Fees in Crypto Overview

In cryptocurrency trading, every transaction falls into one of two categories based on how an order interacts with the market: maker or taker. These terms describe whether a trader is adding liquidity to the exchange’s order book or removing it through an immediate trade.

A maker provides liquidity by placing a limit order that waits for another trader to fill it, while a taker removes liquidity by executing instantly at the current market price. Maker fees are typically lower since they help exchanges maintain liquidity, while taker fees are higher because they consume it right away.

You can find the main differences between maker and taker fees in the table below:

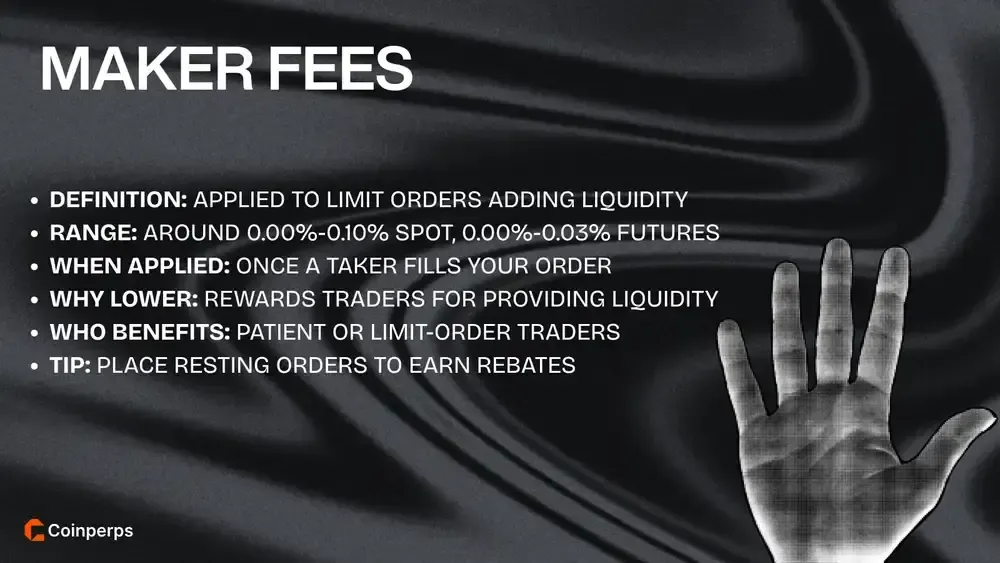

What are Maker Fees?

Maker fees (or market maker fees) in crypto refer to the transaction costs applied when a trader provides liquidity to the market rather than taking it away. These fees reward traders who place orders that add to the existing order book, helping maintain smooth price discovery and market depth.

Key aspects of maker fees in cryptocurrency trading:

- Order type required: Maker fees apply when placing limit orders that do not execute instantly but remain visible in the exchange’s order book.

- Liquidity contribution: These orders make liquidity by offering standing prices that other traders can later match or trade against.

- Typical cost range: On spot exchanges, maker fees usually range from 0.02% to 0.10%, while futures markets average around 0.01% to 0.03%.

- Incentive structure: Exchanges offer lower maker fees to encourage liquidity provision, which improves price discovery and reduces volatility.

- Execution timing: The fee applies only when another trader’s market order fills your resting limit order at your chosen price.

- VIP or volume discounts: Active or institutional traders often pay reduced maker fees as they help sustain deeper, more liquid order books.

- Impact on strategy: Maker fees reward patient, price-sensitive traders who prefer to set controlled entries and exits instead of executing immediately.

Example: If Bitcoin trades between $102,000 and $120,000, and you place a limit sell order at $120,800 on Gate that later fills, your exchange might charge a 0.02% maker fee. On a 0.5 BTC trade, that equals about $12.08 in maker fees for providing liquidity to the market.

What are Taker Fees?

Taker fees in crypto refer to the transaction costs charged when a trader removes liquidity from the market by executing an order immediately. These fees apply when a trader accepts an existing price from the order book, typically through a market order or an instantly matched limit order.

Key aspects of taker fees in cryptocurrency trading:

- Order type required: Taker fees apply when placing market orders or limit orders that execute immediately against resting orders.

- Liquidity removal: These trades "take" liquidity from the order book by consuming the available offers or bids placed by other traders.

- Typical cost range: On most exchanges like Kraken, taker fees range from 0.05% to 0.20%, depending on the platform, trading pair, and user tier.

- Incentive structure: Exchanges keep taker fees higher than maker fees to discourage excessive market impact and reward liquidity provision.

- Execution timing: The fee is charged the moment your order executes instantly, since it removes liquidity rather than adding it.

- VIP or volume discounts: High-volume traders or institutions often benefit from tiered reductions, but taker fees almost always remain higher than maker fees.

- Impact on strategy: Taker fees suit traders who prioritize execution speed, reacting quickly to price moves instead of waiting for better fills.

Example: If Bitcoin trades around $118,000 and you place a market buy order for 0.5 BTC that fills instantly, your exchange might charge a 0.10% taker fee. That equals $59 in taker fees for executing immediately at the available market price instead of posting a limit order.

Comparing Maker & Taker Fees on Crypto Exchanges

Maker and taker fee structures differ across crypto platforms, and understanding how each exchange category approaches them can help traders reduce costs and optimize execution. Below is an overview of how major exchanges structure their fees, discounts, and membership incentives across different market types.

1. Lowest Fee Exchanges

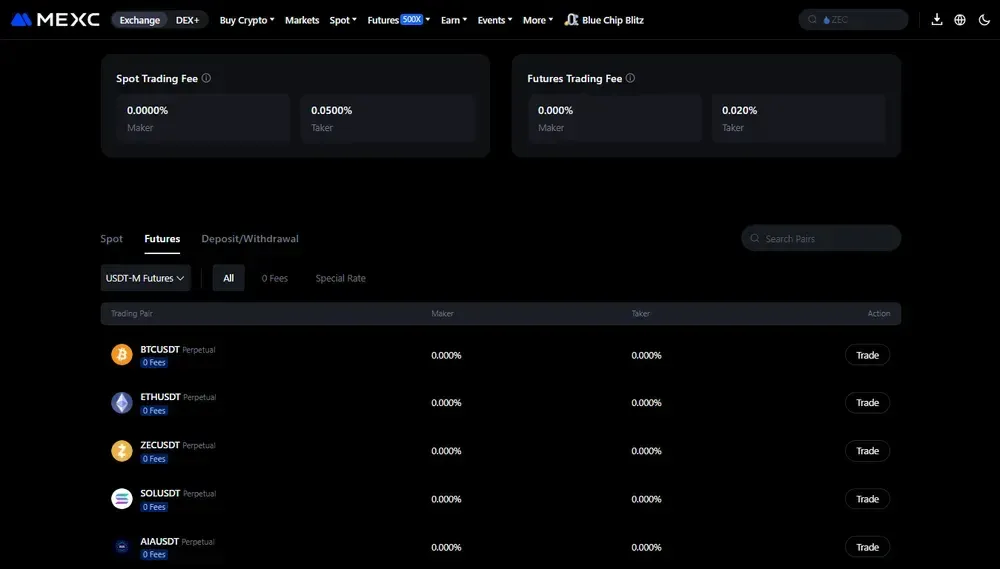

MEXC and KCEX stand out for offering some of the lowest maker and taker fees in the industry. MEXC charges 0.000% maker and 0.050% taker on spot markets, while perpetuals like BTCUSDT and ETHUSDT trade at 0.010% and 0.040%, with pairs such as SOLUSDT and ZECUSDT offering 0% on both sides.

KCEX takes cost-efficiency further with a true zero-fee model for spot trading and just 0.01% taker fees on futures. The exchange also provides zero withdrawal fees, making it an appealing option for active traders frequently moving funds on and off-platform.

2. Best Token-Discount Exchanges

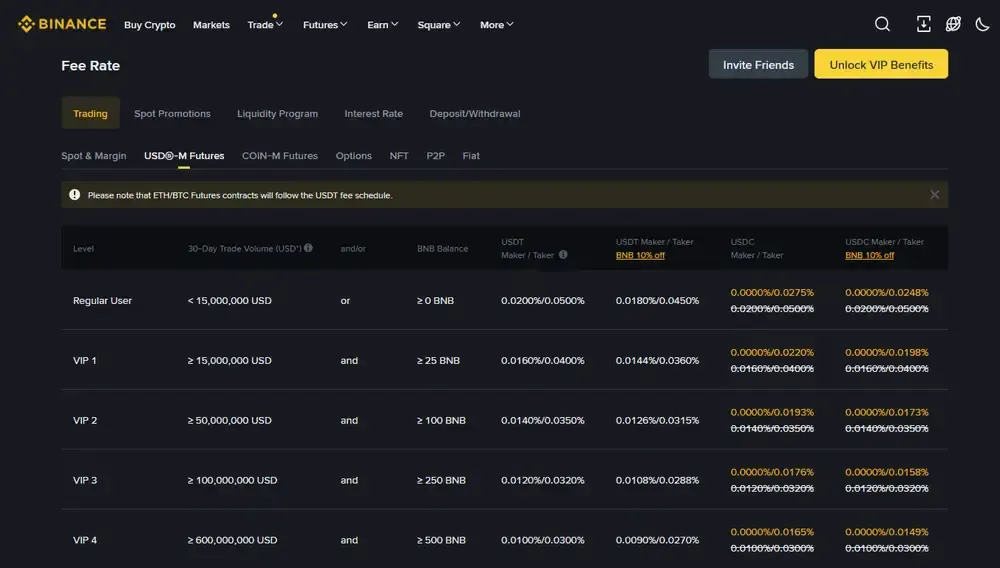

Binance and HTX both offer strong token-based incentives that lower trading costs for users holding their native tokens. Binance reduces its base 0.10% maker and taker fee to 0.075% when paying with BNB, giving traders a consistent 25% savings on every trade.

HTX uses a similar approach through its Prime system, which combines tiered volume levels with token deductions. Spot trading fees can drop from 0.20% to 0.075%, while futures maker fees fall to 0.0108% and taker fees to 0.0360% when paying with HTX or TRX.

3. Top VIP-Tiered Exchanges

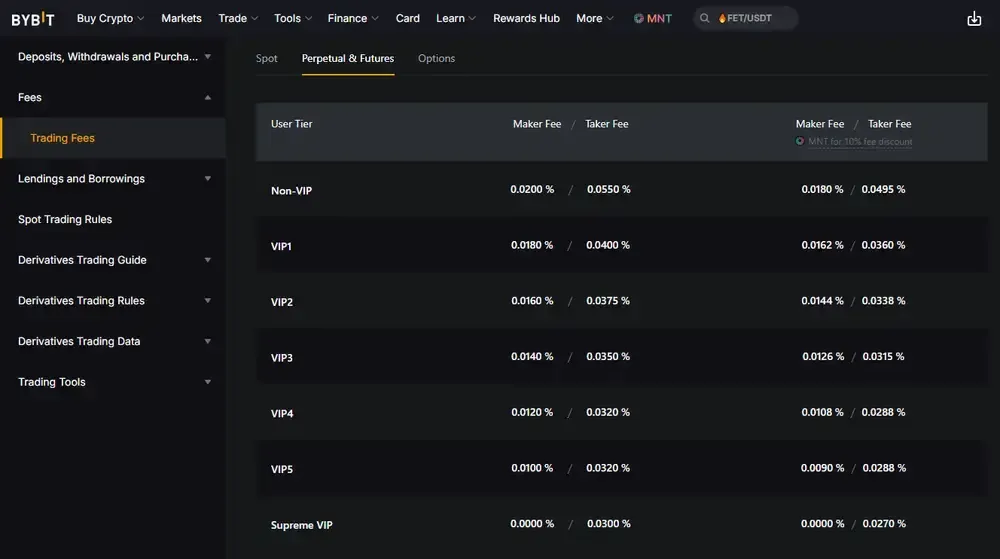

Bybit has one of the most competitive VIP systems, rewarding professional and institutional traders with significantly lower fees. Its spot trading structure drops from 0.10% to 0.045% for takers and from 0.10% to 0.030% for makers as users move up the VIP ladder.

In derivatives, Bybit’s elite “Supreme VIP” level offers 0.00% maker and 0.030% taker fees, providing exceptional cost efficiency for high-frequency traders. This makes Bybit a preferred platform for active participants scaling their trading volumes into multimillion-dollar tiers.

4. Membership-Based Exchanges

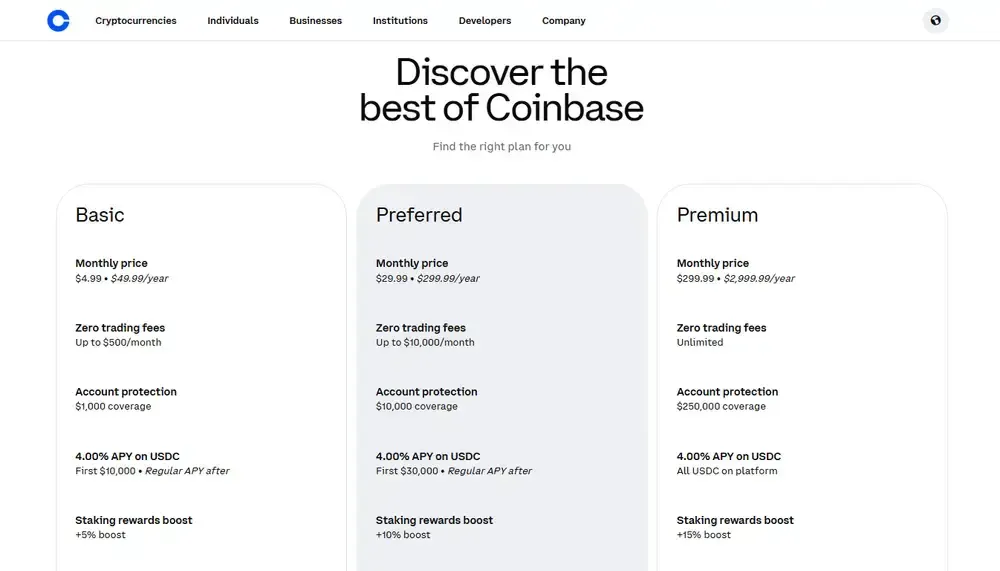

Coinbase's One membership replaces per-trade commissions with a flat subscription model designed for consistent traders. Starting at $4.99 per month, the Basic plan allows up to $10,000 in zero-fee trading, while higher tiers expand to unlimited trades and additional rewards.

Premium members benefit from features like 4% APY on USDC, staking reward boosts up to 15%, and account protection of up to $250,000. For traders who value simplicity and predictable costs, Coinbase One offers an all-inclusive structure rarely seen in traditional maker-taker systems.

5. Decentralized Exchanges (DEXs)

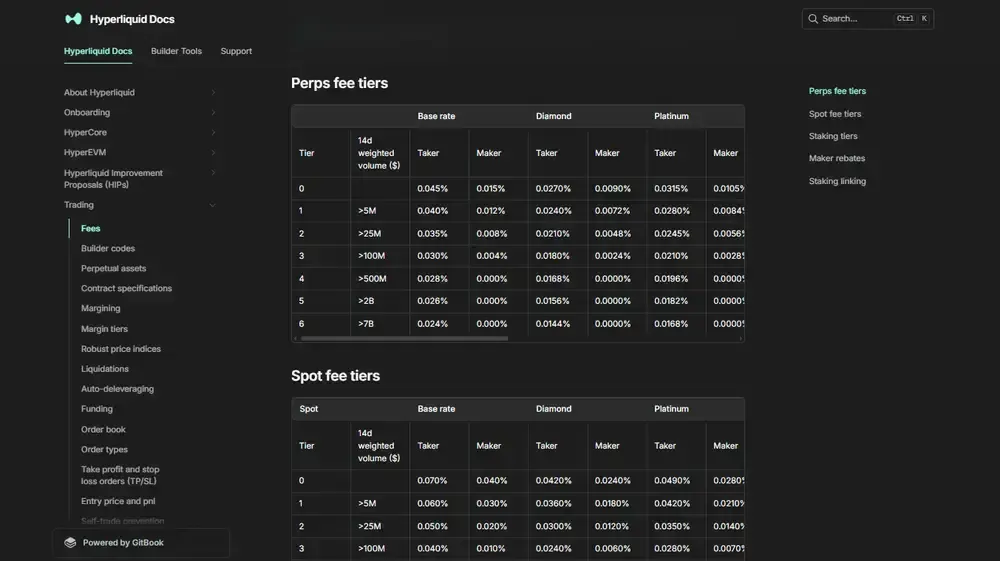

Hyperliquid exemplifies how decentralized platforms adapt the maker-taker model to on-chain environments. It features dynamic tiers starting at 0.045% taker and 0.015% maker, scaling down to 0.024% and 0.000% respectively for high-volume traders.

Unlike centralized exchanges, all collected fees are routed to the Hyperliquid Liquidity Pool (HLP), which supports market stability and trader incentives. This structure redistributes protocol revenue to liquidity providers, maintaining consistent depth without centralized profit retention.

How to Pay Less Fees When Trading Crypto?

The simplest way to reduce trading fees is to use limit orders strategically and consistently whenever possible instead of market orders. By doing so, you act as a maker, often qualifying for lower fees, avoiding slippage, and sometimes even earning small rebates on certain exchanges.

Another effective strategy is to increase your trading volume or loyalty tier on your preferred crypto exchange platform. Many platforms offer progressive fee discounts for traders who reach higher 30-day volume thresholds or hold native exchange tokens like BNB, OKB, or GT.

Finally, always compare fee structures across multiple exchanges and use platforms optimized for low-cost execution. For example, using Hyperliquid’s zero-gas model, Solana, or other L2 networks can greatly reduce both trading and transaction fees, especially for active or high-frequency traders.

Risks of Maker-Taker Fees

Maker-taker fee models in crypto markets can unintentionally distort trading behavior, reduce transparency, and create hidden incentives that impact fair price formation.

Common risks and issues associated with maker-taker fee systems include:

- Liquidity fragmentation: Exchanges competing on larger rebates can unintentionally split liquidity across multiple venues, reducing overall market efficiency and long-term price consistency.

- Rebate chasing: Traders may execute unnecessary or artificial orders purely to collect small maker rebates instead of pursuing genuine market trades.

- Conflict of interest: Some market makers or high-frequency trading firms benefit disproportionately, disadvantaging retail participants with higher average execution and transaction costs.

- Market manipulation: Maker-taker pricing structures can sometimes encourage spoofing or wash trading activity to exploit fee tiers and earn unintended rebates.

- Reduced transparency: Complex and layered fee schedules make it harder for traders to calculate true costs and accurately compare exchanges.

- Order routing bias: Automated execution systems may prioritize venues offering better rebates rather than those ensuring the best possible trade execution quality.

- Volatility amplification: When incentive structures shift abruptly, liquidity providers can withdraw orders rapidly, intensifying short-term price swings during volatile market conditions.

- Exchange dependence: Smaller or emerging exchanges using aggressive rebate schemes risk financial instability if liquidity incentives outweigh sustainable trading volume revenue.

Historically, the maker-taker model has faced criticism even outside crypto markets. In 2014, Jeffrey Sprecher of ICE and the Royal Bank of Canada called for scrutiny of rebate practices, leading to an SEC pilot program later struck down by the U.S. Court of Appeals in 2020.

Bottom Line

Maker-taker fees are one of the most important structural elements in modern crypto trading, influencing liquidity flow, execution quality, and total trading costs across all major exchanges.

Understanding how these fees impact your positions is critical, but they form only one technical component within the broader mechanics of professional trading.

The next step is to study execution methods like take-profit, iceberg, and TWAP orders, along with funding rates and market depth analytics using VWAP, to develop a precise and trading strategy.

Frequently asked questions

Not all exchanges follow the maker-taker model, but it is the most common structure among centralized platforms. Some exchanges, especially decentralized ones (DEXs), use flat swap fees or liquidity pool models instead of separate maker and taker rates.

Yes, exchanges often adjust fee tiers based on your 30-day trading volume, account level, or changing market conditions. High-volume or institutional traders may see reduced rates, while retail traders typically start with standard baseline fees.

Usually yes, but not always. Some exchanges temporarily equalize both to simplify pricing or during promotional events, while others offer negative maker fees (rebates) to attract liquidity providers in specific markets.

On DEXs, the concept differs since trades happen through automated market makers (AMMs) instead of order books. In this case, traders pay a single liquidity provider fee, usually around 0.05% to 0.30%, shared between liquidity providers and the protocol treasury.

.avif)